It’s Not Going to Be Easy Being Green: Final SEC Climate Rules

March 7, 2024

On March 6, the SEC issued its long-awaited final rules on climate disclosures.

At a high level, the SEC has softened or eliminated some of the expansive requirements of the proposed rules, reflecting the pushback the SEC received on many fronts. At the same time, the final rules continue to represent a significant expansion of existing disclosure and compliance requirements that will require reexamination of and changes to data gathering, controls, governance and disclosure practices.

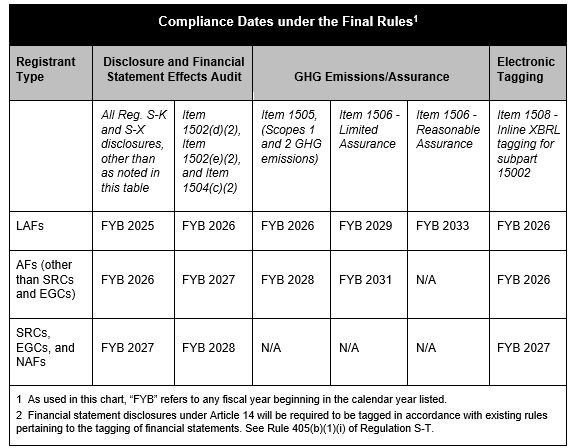

Compliance dates are also much more reasonable than in the proposed rules, with the first disclosures for large accelerated filers due in filings related to fiscal year 2025 (in early 2026). See the compliance date table below for phase in of different elements of the rules based on filer status, including with respect to foreign private issuers (FPIs).

You’ll hear more from us later with a detailed analysis of the final rules and a series of guides to aid you in preparing for the final rule requirements and reconciling compliance with multiple disclosure regimes. In the meantime, here are the key aspects of the final rules:

GHG Emissions and Attestation Report – No Scope 3!

- The biggest change is that Scope 1 and Scope 2 GHG emissions disclosures are only required for large accelerated filers and accelerated filers (and only to the extent material); non-accelerated filers, SRCs and EGCs do not need to disclose any GHG emissions disclosures

- GHG emissions disclosures no longer need to be disaggregated by constituent gas; disclosures only need to be in the aggregate in terms of CO2e, unless any one constituent gas is individually material (in which case only that constituent gas must be disaggregated)

- GHG intensity, or carbon intensity, disclosure requirements have also been removed

- To provide additional time to finalize GHG emissions data, GHG emissions disclosures can be filed with the Q2 Form 10-Q immediately following the fiscal year to which the GHG emissions disclosures relate (or as an amendment to the Form 10-K by the Q2 10-Q filing deadline). FPIs can wait to file GHG emissions disclosures within 225 days after the end of the fiscal year to which the GHG emissions disclosures relate in an amendment to their Form 20-F; these amendments cannot be furnished on Form 6-K

- Where required in registration statements, GHG emissions disclosures must be provided on the same timing as for annual filings

- Large accelerated filers and accelerated filers will be required to file limited assurance attestation reports after three years of GHG emissions disclosure reporting, and only large accelerated filers will eventually be required to obtain reasonable assurance; other filers are not required to file attestation reports

- The final rules are more flexible as to the form and content of the attestation reports, but similar to certain disclosures required for auditors, changes to providers or disagreements with any former providers must be disclosed

- The attestation report must be filed as new exhibit 27 to the applicable annual report and registration statement filings

Notes to the Financial Statement – Modification of 1% Threshold

- Registrants will be required to disclose the expenditures or capitalized costs related to severe weather events and other natural conditions that have an impact greater than 1% of the absolute value of the company’s income or loss before taxes for the fiscal year (in the case of expenditures expensed as incurred and losses) or stockholders’ equity or deficit at the end of the fiscal year (in the case of capitalized costs and charges), subject to certain de minimis threshold amounts

- The final rules require registrants to disclose material expenditures related to activities to mitigate or adapt to climate-related risk (in management’s assessment), disclosed transition plans, and disclosed targets and goals

- If carbon offsets or RECs have been used as a material component of plans to achieve disclosed climate-related targets or goals, the final rules also require financial statement footnote disclosure of the aggregate amount of carbon offsets or RECs expensed, capitalized carbon offsets or RECs recognized, and losses incurred on the capitalized carbon offsets and RECs

- In response to comments, the SEC adopted a principle that requires companies to attribute an expenditure or recovery to a severe weather event or other natural condition and disclose the entire amount of the expenditure or recovery when the event or condition is a “significant contributing factor” in incurring the expenditure or recovery

Governance, Risk and Targets/Goals – More Streamlined Requirements

- The final rules added materiality qualifiers in a number of places, including to limit:

- the discussion of management oversight to just material climate-related risks;

- climate-related risk disclosure to material physical or transition risks (with no disclosure required if there are no material climate-related risks); and

- discussion of targets or goals to just those that are material, eliminating the need to disclose preliminary targets and goals that are used for internal planning purposes and are not yet material (although a formal adoption of a target or goal is not required for disclosure to be triggered)

- The final rules eliminate the requirement to disclose any “climate expert” on the Board, but registrants are still required to disclose management expertise

- The final rules reduce certain detailed disclosure about climate-related targets and goals, including removing disclosure of interim targets, although annual disclosure of the progress made towards targets and goals during each fiscal year remains in the final rules

- The final rules provide a safe harbor for climate-related disclosures relating to transition plans, scenario analysis, the use of an internal carbon price and targets and goals: all such information, except for historical facts, is considered “forward-looking information” for purposes of the PSLRA safe harbors

- The final rules eliminate the requirement that material changes to the climate-related disclosures would need to be updated in a subsequent Form 10-Q or Form 6-K for FPIs

Finalized Compliance Dates

The final rules provide compliance dates that are dependent on the particular disclosure requirement and on the registrant’s filing status:

Litigation Challenges

- Legal challenges to the final rules have already begun and we expect that others will be filed in the coming days

- Only hours after the final rules were adopted, a coalition of ten states led by West Virginia and Georgia announced that it had filed suit in the Eleventh Circuit challenging the final rules

- Liberty Energy Inc. and Nomad Proppant Services LLC filed a suit in the Fifth Circuit, which is a common forum for petitioners to challenge SEC rules and the court that recently struck down the repurchase rules. The petitioners in the Liberty Energy case have said they intend to seek emergency relief, including requesting a ruling within ten days

- The U.S. Chamber of Commerce Center for Capital Markets Competitiveness also announced that they are considering whether to challenge the final rules

- Opponents will have 60 days from the adoption date (until May 6, 2024) to file a petition seeking judicial review

- Although we expect a number of legal challenges to be filed against the final rules, any such petitions do not have an immediate tolling effect. A petitioner would have to either seek a stay from the SEC pending judicial review, which may be granted when “justice so requires,” or request a stay from a court, which may be granted to the extent necessary to prevent irreparable injury

Now What? Next Steps towards Compliance

Now that the final rules are out, companies can further refine and focus the preparation and compliance efforts that have been ongoing over the past year. In particular, as important next steps, companies should consider:

- Socializing the final rules (and the key differences from the proposed rules) with the relevant teams internally, including with the board

- Coordinating with internal audit and external auditors, any GHG emissions experts, advisors or other consultants, and any current attestation report providers

- Refreshing the gap analysis between the company’s current status and where it needs to be under the final rules

- Preparing a plan for fine-tuning and test running the company’s internal controls, disclosure controls and other processes as they relate to these new climate-related disclosure requirements to ensure everything works as intended

- Coordinating with management and other relevant personnel on published or planned targets and goals, usage of carbon credits and offsets, climate transition plans, scenario analysis calculations and climate-related risk assessments and prepare a strategy for rolling them out (in light of the new rules) or disclosing them pursuant to the new requirements (if already published)

Click the links for a more detailed outline of the requirements of the final rules and a blackline of the final rules against the proposed rules.

We are here to help – we would be happy to schedule discussions with you and your teams to discuss the final rules in more detail.